Exploring the White Oak Impact Fund: Driving Positive Change through Strategic Investment

In the landscape of modern finance and investment, the focus has increasingly shifted toward socially responsible investing (SRI) and impact investing. Among the key players in this arena is the White Oak Impact Fund, an organization committed to generating positive social and environmental outcomes alongside financial returns. This article delves into the mission, strategies, and impact of the White Oak Impact Fund, highlighting its role in fostering sustainable development and driving positive change.

Understanding the White Oak Impact Fund

Founded with the vision of making a meaningful difference, the White Oak Impact Fund operates at the intersection of finance and social responsibility. It seeks to invest in projects and initiatives that yield tangible benefits for communities, the environment, and the economy. By prioritizing impact alongside profit, the fund aligns itself with the growing demand for investments that contribute to a sustainable future.

The Mission of the White Oak Impact Fund

The mission of the White Oak Impact Fund is clear: to create lasting positive change through strategic investments that support underrepresented communities, promote sustainability, and drive economic growth. The fund focuses on several key areas:

- Affordable Housing: Ensuring access to safe and affordable housing for low-income families is a primary focus. The fund invests in developments that provide quality housing solutions, fostering community stability and growth.

- Education and Workforce Development: By supporting educational initiatives and job training programs, the White Oak Impact Fund aims to empower individuals with the skills and knowledge necessary for economic mobility.

- Environmental Sustainability: The fund is committed to investing in projects that promote renewable energy, sustainable agriculture, and conservation efforts. By prioritizing environmental stewardship, the White Oak Impact Fund helps mitigate the effects of climate change and supports ecological balance.

- Healthcare Access: Improving access to quality healthcare services is another critical area of focus. The fund supports initiatives that enhance healthcare infrastructure and provide essential services to underserved populations.

The Investment Strategy of the White Oak Impact Fund

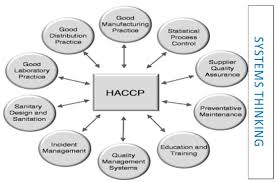

The White Oak Impact Fund employs a rigorous investment strategy designed to maximize both financial returns and social impact. Here are some key components of this approach:

1. Rigorous Due Diligence

Before making any investment, the White Oak Impact Fund conducts thorough due diligence to assess potential projects. This process involves analyzing the financial viability of the investment, as well as its potential social and environmental impact. The fund aims to ensure that its investments align with its mission and values.

2. Collaborative Partnerships

Collaboration is a cornerstone of the White Oak Impact Fund’s strategy. The fund works closely with local organizations, community leaders, and other stakeholders to identify investment opportunities that will yield meaningful results. By leveraging the expertise and insights of these partners, the fund can make informed decisions that maximize impact.

3. Focus on Measurement and Evaluation

To ensure accountability and transparency, the White Oak Impact Fund places a strong emphasis on measuring and evaluating the outcomes of its investments. The fund employs various metrics and frameworks to assess both financial performance and social impact. This commitment to measurement allows the fund to refine its strategies and improve its effectiveness over time.

4. Long-Term Commitment

The White Oak Impact Fund takes a long-term approach to investing. Rather than seeking quick returns, the fund is dedicated to fostering sustainable change over time. This perspective allows for more significant impacts and aligns with the fund’s mission of creating lasting benefits for communities.

Success Stories: Impact of the White Oak Impact Fund

The effectiveness of the White Oak Impact Fund can be seen through several success stories that exemplify its commitment to driving positive change. Here are a few notable examples:

1. Affordable Housing Development

In a major city, the White Oak Impact Fund invested in the construction of affordable housing units that cater to low-income families. This project not only provided safe and stable housing but also revitalized a neighborhood, attracting new businesses and services. The initiative fostered community pride and improved overall quality of life for residents.

2. Workforce Development Programs

The fund partnered with a local nonprofit organization to develop a job training program targeting underserved populations. By providing skills training and job placement services, the initiative empowered individuals to secure stable employment and achieve economic independence. This project not only benefited participants but also contributed to the local economy by reducing unemployment rates.

3. Renewable Energy Projects

The White Oak Impact Fund has also made significant strides in promoting environmental sustainability. By investing in renewable energy projects, such as solar farms and wind energy initiatives, the fund has helped reduce reliance on fossil fuels and lower carbon emissions. These projects contribute to a greener future while providing job opportunities in the renewable energy sector.

4. Healthcare Access Initiatives

In response to the COVID-19 pandemic, the White Oak Impact Fund supported initiatives aimed at improving healthcare access for underserved communities. This included funding for mobile health clinics and telehealth services, ensuring that vulnerable populations received essential medical care during a critical time. The fund’s commitment to healthcare access has had a lasting impact on community health outcomes.

The Importance of Impact Investing

Impact investing, as exemplified by the White Oak Impact Fund, is gaining traction as a viable alternative to traditional investing. Here are several reasons why impact investing is important:

1. Addressing Social Challenges

Impact investing provides a means to address pressing social issues such as poverty, inequality, and environmental degradation. By directing capital toward initiatives that promote social good, investors can play a role in creating positive change.

2. Aligning Values with Investments

Many investors today seek to align their financial decisions with their personal values. Impact investing allows individuals and institutions to invest in projects that resonate with their beliefs, making a difference while also achieving financial returns.

3. Fostering Innovation

Impact investing encourages innovation by funding new ideas and solutions to societal challenges. Entrepreneurs and organizations with creative approaches to social issues can secure the capital needed to scale their efforts and make a broader impact.

4. Building Resilient Communities

By investing in projects that promote economic development, education, and healthcare access, impact investing helps build resilient communities. These investments contribute to long-term stability and prosperity, benefiting both individuals and society as a whole.

Challenges and Considerations in Impact Investing

While the White Oak Impact Fund and similar organizations have made significant strides in impact investing, there are challenges to consider:

1. Measuring Impact

Measuring the social and environmental impact of investments can be complex. Establishing clear metrics and evaluation frameworks is essential for assessing effectiveness and ensuring accountability.

2. Balancing Financial Returns with Social Goals

Investors must find a balance between achieving financial returns and meeting social objectives. Striking this balance can be challenging, as some impactful projects may require longer timeframes to yield returns.

3. Competition for Funding

As interest in impact investing grows, competition for funding increases. Many worthy initiatives seek financial support, making it essential for organizations like the White Oak Impact Fund to prioritize and select projects that align with their mission.

The Future of the White Oak Impact Fund

The future of the White Oak Impact Fund appears promising as it continues to navigate the evolving landscape of impact investing. Here are some potential directions for the fund:

1. Expanding Investment Focus

As the fund grows, there may be opportunities to expand its investment focus into new areas, such as technology for social good or climate resilience projects. Diversifying the portfolio can enhance impact and attract a broader range of investors.

2. Strengthening Community Partnerships

Continuing to strengthen partnerships with local organizations and community leaders will be crucial for the fund’s success. Collaborative efforts can enhance the effectiveness of investments and ensure that they meet the specific needs of communities.

3. Increasing Awareness and Education

The White Oak Impact Fund can play a role in increasing awareness of impact investing and educating potential investors. By sharing success stories and best practices, the fund can inspire others to engage in socially responsible investment strategies.

4. Emphasizing Transparency and Accountability

Maintaining transparency and accountability will be vital for building trust with investors and communities. The fund should continue to share its impact metrics and regularly communicate progress toward its mission.

Conclusion

The White Oak Impact Fund represents a powerful movement toward integrating social responsibility with investment strategies. By prioritizing affordable housing, education, environmental sustainability, and healthcare access, the fund demonstrates that financial success and positive social impact can go hand in hand.

As the landscape of impact investing continues to evolve, the White Oak Impact Fund stands as a model for how strategic investments can drive meaningful change. Through its commitment to rigorous evaluation, collaboration, and long-term thinking, the fund is poised to make a lasting difference in the communities it serves.

For those interested in investing with purpose, the White Oak Impact Fund offers a compelling opportunity to align financial goals with a commitment to social good. By supporting initiatives that create tangible benefits for individuals and communities, investors can play a crucial role in shaping a more equitable and sustainable future.